The Organization of the Petroleum Exporting Countries (OPEC) is a powerful consortium that plays a significant role in the global oil market. Understanding who controls OPEC requires delving into its structure, key players, and the dynamics within the organization. OPEC is not controlled by a single entity but is instead influenced by a complex interplay of member states, each with its own interests and agendas.

OPEC’s Structure and Governance

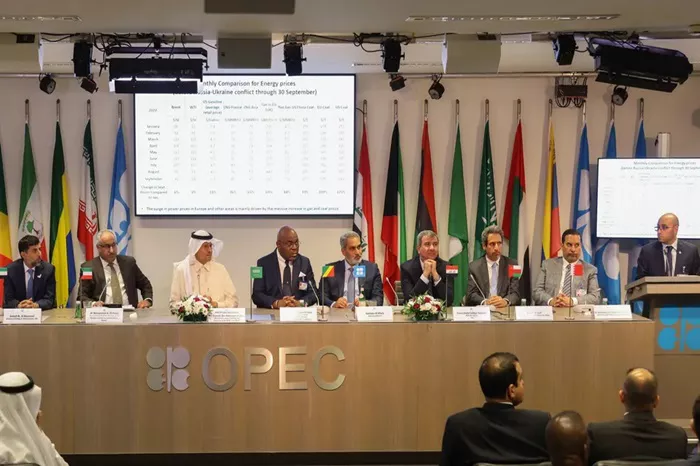

OPEC was founded in 1960 by five countries: Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela. It has since expanded to include 13 member countries as of 2024. The organization’s headquarters is in Vienna, Austria. OPEC’s primary goal is to coordinate and unify petroleum policies among member countries, ensuring the stabilization of oil markets to secure a steady income for producers and a fair return on capital for those investing in the petroleum industry.

The governance of OPEC is organized through several key bodies:

The Conference: This is the supreme authority of the organization, consisting of delegations from each member country. The conference meets biannually to set policies and make major decisions regarding production targets and strategies.

The Board of Governors: Comprising representatives from each member country, the Board of Governors meets more frequently and oversees the implementation of conference decisions. They also prepare the annual budget and manage the day-to-day operations of the organization.

The Secretariat: Headed by the Secretary-General, the Secretariat is responsible for the administrative and technical work of OPEC. The Secretary-General is elected for a three-year term and plays a critical role in representing OPEC to the outside world and coordinating internal activities.

Key Players in OPEC

While OPEC operates on a principle of collective decision-making, not all members have equal influence. Historically, Saudi Arabia has been the de facto leader of OPEC, often referred to as the “first among equals.” This is largely due to its vast oil reserves and production capacity, which give it significant leverage over the organization’s policies.

Saudi Arabia: As the largest oil producer in OPEC, Saudi Arabia wields considerable influence over the organization’s decisions. It often acts as the swing producer, adjusting its output to stabilize global oil prices. Saudi Arabia’s economic and geopolitical interests heavily shape OPEC’s strategies. The kingdom’s ability to endure lower oil prices longer than many other members gives it substantial clout during negotiations.

Other Influential Members: Besides Saudi Arabia, other influential members include:

Iran: Despite facing international sanctions and internal economic challenges, Iran remains a significant player due to its substantial oil reserves. The geopolitical rivalry between Iran and Saudi Arabia often complicates OPEC’s decision-making processes.

Iraq: As one of the founding members, Iraq’s large oil reserves make it a key player in OPEC. However, its influence is somewhat diminished by internal political instability and security issues.

The United Arab Emirates (UAE): Particularly through Abu Dhabi, the UAE has emerged as a prominent voice within OPEC. The country’s ambitious energy policies and investments in oil infrastructure strengthen its position within the organization.

Nigeria and Angola: These African producers are significant due to their production volumes and growing importance in the global oil market.

Internal Dynamics and Conflicts

OPEC’s ability to function effectively depends on the cohesion among its members, but this is often challenged by differing national interests. The organization has witnessed numerous internal conflicts over production quotas, pricing strategies, and geopolitical alliances.

Price Hawks vs. Price Doves: Historically, OPEC’s internal divisions have been characterized by the dichotomy between price hawks and price doves. Price hawks, such as Iran and Venezuela, prefer higher oil prices to boost national revenues. In contrast, price doves, typically led by Saudi Arabia, advocate for moderate prices to maintain market share and long-term stability.

Geopolitical Rivalries: Regional power struggles, particularly between Saudi Arabia and Iran, frequently influence OPEC’s decisions. These rivalries can lead to disagreements over production levels and pricing policies, complicating the organization’s ability to present a united front.

Economic Needs and Budgetary Pressures: Different economic conditions and budgetary needs among member states also drive internal tensions. Countries with strained budgets, like Venezuela and Nigeria, push for higher oil prices to meet domestic financial requirements, whereas wealthier nations like Saudi Arabia can afford more flexible pricing strategies.

The Role of OPEC+

In recent years, the role of OPEC has evolved with the formation of OPEC+, an alliance between OPEC members and other major oil producers, including Russia, Mexico, and Kazakhstan. OPEC+ was created in 2016 to better manage oil production and stabilize prices in response to market volatility.

Russia’s Influence: Among the non-OPEC members, Russia stands out as a crucial partner. Its vast oil production capacity and geopolitical weight make it a key player in OPEC+ negotiations. The cooperation between Saudi Arabia and Russia, often referred to as the “OPEC+ axis,” is pivotal in shaping global oil policies.

Production Agreements: OPEC+ has been instrumental in coordinating production cuts to counteract the impact of events like the COVID-19 pandemic, which saw a dramatic decline in oil demand. These agreements have helped stabilize oil markets, although compliance and enforcement of production quotas remain ongoing challenges.

Challenges and Future Outlook

OPEC faces several challenges that could impact its future influence and control over the global oil market:

Market Competition and Cheating: One of the perennial issues within OPEC is the tendency of member countries to cheat on their production quotas. This undermines collective efforts to manage oil supply and stabilize prices.

Energy Transition: The global shift towards renewable energy sources and the push for decarbonization pose long-term challenges to OPEC’s dominance. As countries invest more in alternative energies, the demand for oil could decrease, affecting OPEC’s market power.

Geopolitical Instability: Ongoing conflicts and political instability in key member countries, such as Libya and Iraq, can disrupt production and affect OPEC’s ability to maintain consistent output levels.

Technological Advancements: Technological innovations in oil extraction, such as hydraulic fracturing (fracking) and deepwater drilling, have increased oil supplies from non-OPEC countries, particularly the United States. This has diminished OPEC’s ability to control global oil prices.

Conclusion

Control within OPEC is a multifaceted and dynamic issue. While Saudi Arabia holds significant sway due to its production capacity and economic resilience, the organization operates through a collective decision-making process that requires consensus among its members. The internal dynamics of OPEC are shaped by a variety of factors, including economic needs, geopolitical rivalries, and the evolving landscape of the global energy market.

As OPEC navigates these challenges, its ability to adapt and coordinate with OPEC+ will be crucial in maintaining its relevance and influence in the years to come. Understanding who controls OPEC involves recognizing the complex interplay of member states’ interests, the pivotal role of Saudi Arabia, and the broader geopolitical and economic context in which the organization operates.

Related topics:

7 Reasons Why The USA Is Not A Member Of Opec