The Organization of the Petroleum Exporting Countries (OPEC) has long been a focal point of global energy discussions, often scrutinized for its influence over oil prices and market dynamics. At the heart of many debates surrounding OPEC is the question of whether it operates as a monopoly. This article delves into the complexities of OPEC’s structure, its historical impact on oil markets, and the ongoing relevance of the monopoly label in today’s global economy.

Understanding OPEC’s Formation and Objectives

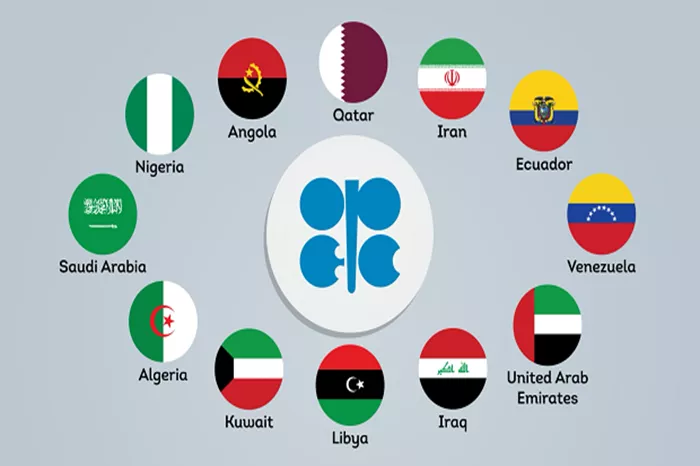

Founded in 1960 by five major oil-producing countries—Saudi Arabia, Iran, Iraq, Kuwait, and Venezuela—OPEC aimed to unify petroleum policies among its members. The initial objective was to stabilize oil markets, ensuring fair prices for both producers and consumers amidst the fluctuations inherent in the oil industry. Over the decades, OPEC has expanded to include fourteen member countries, each with varying degrees of influence over global oil production and pricing.

The Role of OPEC in Global Oil Markets

OPEC’s influence stems primarily from its collective ability to adjust oil production levels among member nations. By coordinating output, OPEC can impact global supply and consequently influence prices. This ability has led to accusations that OPEC acts as a monopoly, wielding undue control over a vital global commodity.

Economic Theory and Monopoly Characteristics

In economic terms, a monopoly is characterized by a single entity or a group of entities that control the supply of a good or service in a market. Monopolies often result in reduced competition, allowing the controlling entity to set prices above competitive levels. While OPEC does not fit the traditional definition of a monopoly—where a single seller dominates a market—it exhibits some monopoly-like behaviors due to its significant market share and collective production decisions.

OPEC’s Market Share and Pricing Power

Critics argue that OPEC’s collective decisions on oil production quotas effectively limit global supply, influencing prices to benefit member countries economically. This perceived pricing power has sparked debates over whether OPEC’s actions harm consumer welfare by artificially inflating oil prices beyond what would prevail in a competitive market.

Legal and Regulatory Perspectives

From a legal standpoint, accusations of monopoly behavior against OPEC have been contentious. The organization operates as a coalition of sovereign nations, complicating efforts to apply traditional antitrust laws designed for private corporations. International law offers limited recourse for challenging OPEC’s decisions, as member countries are often shielded by principles of sovereignty and diplomatic immunity.

See also: Is OPEC A Cartel?

OPEC’s Response to Criticism and Market Pressures

Over the years, OPEC has faced considerable scrutiny from consumer nations, international organizations, and non-member oil producers. In response, OPEC has emphasized its role in promoting market stability and ensuring long-term investment in oil production infrastructure. The organization argues that its actions are necessary to prevent price volatility, which can destabilize economies reliant on oil revenues.

The Evolution of OPEC’s Influence

The global energy landscape has evolved significantly since OPEC’s formation. Technological advancements in oil extraction, the rise of alternative energy sources, and geopolitical shifts have all impacted OPEC’s influence over oil markets. Non-OPEC countries, particularly the United States with its shale oil revolution, have emerged as significant producers, challenging OPEC’s dominance and influencing global supply dynamics.

OPEC’s Strategic Adjustments and Future Prospects

In response to these shifts, OPEC has adapted its strategies, including alliances with non-member oil-producing nations like Russia (known as OPEC+). These alliances aim to leverage combined production capacities to maintain influence over oil prices amidst changing market conditions. However, questions persist about the long-term sustainability of such alliances and OPEC’s ability to navigate future challenges, including climate change policies and global energy transition efforts.

Conclusion

In conclusion, labeling OPEC as a monopoly requires nuanced consideration of economic principles, legal frameworks, and geopolitical realities. While OPEC does exert significant influence over oil markets, its operations are constrained by internal divisions, external market forces, and evolving global energy dynamics. Accusations of monopolistic behavior highlight broader debates about market competition, regulatory oversight, and the balance of power in international trade.

As the world continues to grapple with energy security and sustainability challenges, understanding OPEC’s role remains crucial for policymakers, economists, and stakeholders across the globe. Whether viewed as a monopoly or a strategic coalition, OPEC’s decisions will continue to shape global oil markets and influence the trajectory of the energy transition in the years to come.

Related topics: