Saudi Aramco, the world’s largest oil company, is making a strategic bet on the enduring relevance of internal combustion engines (ICEs), despite the growing dominance of electric vehicles (EVs). The state-owned giant recently invested €740 million for a 10% stake in Horse Powertrain, a firm specializing in fuel-based engine production.

Yasser Mufti, Saudi Aramco’s executive vice-president overseeing the deal, emphasized the economic and practical challenges of completely phasing out ICEs. “It will be incredibly expensive for the world to completely stamp out, or do without internal combustion engines,” he stated, predicting their persistence for a “very, very long time.”

This stance contrasts with earlier predictions of ICE obsolescence by 2035 or 2040, as announced by major automakers and governments. Despite these declarations, the demand for ICE vehicles remains resilient, bolstered by hybrid technologies and regional market dynamics.

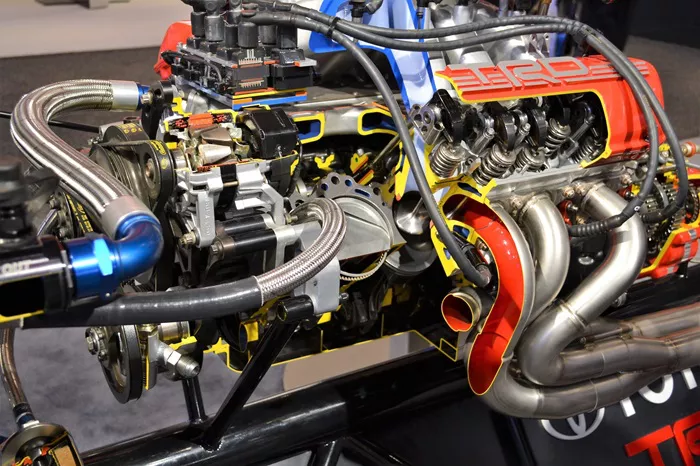

Matias Giannini, CEO of Horse, highlighted the company’s strategy to fill the gap left by automakers pivoting away from internal engine development. “We continued to invest in engine innovation,” Giannini affirmed, noting their readiness to supply a diverse range of engines tailored to new regulatory standards.

The joint venture, formed by Geely and Renault, aims to streamline production and cater to a global market. With 17 factories worldwide capable of producing millions of units annually, Horse sees itself as a pivotal player in the hybrid vehicle transition.

Despite global trends favoring EV adoption, industry analysts like Philippe Houchois from Jefferies suggest that the shift away from ICEs may proceed slower than anticipated. He highlighted opportunities for companies like Honda and Nissan to leverage Horse’s manufacturing capabilities.

While Europe remains a focal point for phasing out ICEs, other regions such as China and the United States continue to prioritize hybrid technologies over full electrification. This geopolitical divergence underscores Saudi Aramco’s strategic expansion into emerging markets like Chile and Pakistan, where conventional fuel vehicles are projected to remain popular.

In parallel, Saudi Aramco is intensifying efforts to expand its global network of filling stations and advance research in synthetic and low-carbon fuels. Ahmad al-Khowaiter, Saudi Aramco’s technology and innovation chief, underscores the potential of synthetic fuels as a transitional solution to reduce carbon emissions in existing vehicles.

Mufti emphasized ongoing advancements in combustion engine technology, aiming to enhance their competitiveness in terms of cost and sustainability compared to EVs. The incorporation of US lubricant brand Valvoline into Horse’s production aligns with this commitment to efficiency and performance.

Looking ahead, the success of Saudi Aramco and Horse’s venture hinges on widespread industry acceptance and adoption. Giannini stressed the importance of clarifying Horse’s role as an independent supplier, poised to support diverse automotive needs without bias towards its parent companies.

In conclusion, while the future of mobility trends towards electrification, Saudi Aramco’s strategic investment in Horse underscores a steadfast belief in the enduring significance of internal combustion engines for the foreseeable future.

Related topics:

Malaysia’s Petrol Subsidy Plans In Jeopardy After Election Setback

Soaring Petrol Prices Hit Northern Nigeria Amid Subsidy Removal