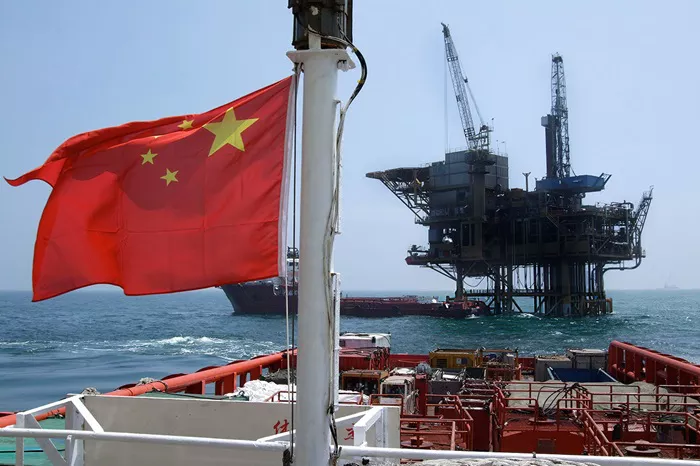

Oil prices continued to face pressure in Asian trading on Wednesday, driven by mounting concerns over China’s economic growth and its impact on oil demand. This bearish sentiment was partially offset by an anticipated decrease in U.S. crude oil inventories.

In early Asian trading, both major oil benchmarks experienced declines of approximately 0.2%. The U.S. West Texas Intermediate (WTI) Crude benchmark managed to recover to around $80 per barrel after dipping to $79.50 earlier in the day. Meanwhile, the international Brent Crude benchmark fell to approximately $83.60, extending its downward trend for a third consecutive day.

The strength of the U.S. dollar has exerted additional downward pressure on oil prices. A stronger greenback generally makes oil more expensive for holders of other currencies, contributing to the recent price declines.

Recent data from China has exacerbated the situation. The country’s GDP growth for the second quarter was reported at 4.7%, falling short of the anticipated 5.1%. Additionally, retail sales for June were below expectations, and refinery output in China decreased by 3.7% compared to the same month last year. The decline in refining activity is attributed to weak fuel demand and diminishing refining margins, leading independent refiners to cut back on crude processing.

China’s crude oil imports also fell by 11% in June from the record highs achieved in June 2023, reflecting subdued demand and refining margins. The International Energy Agency (IEA) highlighted in its recent monthly report that disappointing consumption figures from China are slowing global oil demand growth.

Despite these negative factors, an estimated drop of 4.44 million barrels in U.S. crude oil inventories and the potential for a Federal Reserve interest rate cut in September provided some support for WTI prices, preventing them from remaining below $80 per barrel earlier on Wednesday.

Related topics: