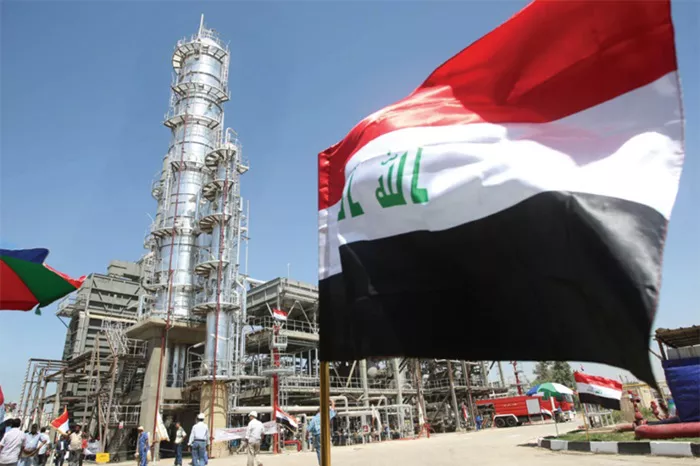

Iraq’s upstream oil and gas sector is experiencing a period of transformation marked by increased corporate interest and substantial investment aimed at enhancing production. However, the sector continues to confront significant infrastructure and exploration challenges.

According to a recent report by Wood Mackenzie, “Iraq’s Upstream Opportunities: A Review,” the country’s gas production is projected to more than double by 2030, reaching 4.4 billion cubic feet per day (bcfd). Oil output is also expected to increase, potentially hitting 5.5 million barrels per day (bpd) within the same timeframe.

Alexandre Araman, director at Wood Mackenzie, commented on the sector’s evolution, noting, “Iraq’s upstream industry is changing dramatically, and it has the resources to significantly boost both oil and gas output. Corporate interest is on the rise due to numerous large-scale entry opportunities. Major oil companies are reassessing their investments due to historically low returns from punitive fiscal terms, while Southeast Asian national oil companies (NOCs) and state-backed Chinese firms are stepping in as potential buyers.”

The report identifies substantial growth potential in Iraq’s large southern oil fields, including Rumaila, West Qurna, Zubair, and Majnoon. Despite this, significant challenges persist.

“Operators face several obstacles to increasing production, particularly related to infrastructure,” said Araman. “Current export pipelines, terminals, and water injection capacities are inadequate. Additionally, fiscal issues complicate efforts to generate value from oil production.”

The stringent fiscal terms have deterred foreign investment and exploration efforts. Wood Mackenzie’s report highlights that, despite Iraq’s vast oil reserves of over 150 billion barrels, only five exploration wells have been drilled in Federal Iraq since 2013.

Recent licensing rounds in 2024 have attracted substantial interest from Chinese companies, signaling a shift toward greater involvement from Asian investors. This shift reflects the evolving corporate landscape in Iraq, which is increasingly drawing interest from diverse international players, especially from Asia.

Araman emphasized that Iraq’s fiscal terms remain among the least competitive in the Middle East, which continues to hinder exploration interest. “Addressing these fiscal issues could potentially lead to increased activity from Asian investors. With improvements in fiscal terms and critical infrastructure, there could be more opportunities for mergers and acquisitions and future production growth,” he added.

Araman also noted that Iraq’s ambitious goals to double gas production, eliminate flaring, and end import reliance are supported by 100 trillion cubic feet (tcf) of gas resources and strong political will. These factors present new investment opportunities. Due to the current fiscal terms, gas projects are often more commercially attractive than oil developments, prompting major players to shift their focus toward gas-centered investments.

Related topic: