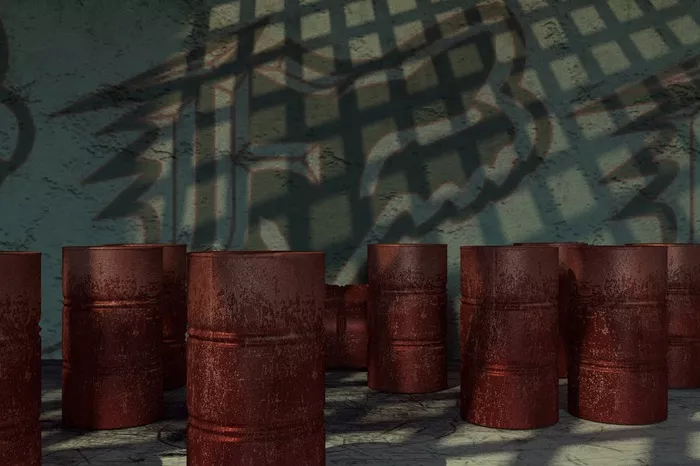

Oil prices remained relatively unchanged during Thursday’s intraday trading sessions, following a sharp decline of more than 4% on Tuesday, which brought prices to a near two-week low. This drop was driven by eased concerns about disruptions in Iranian oil supply. As of 12:50 p.m. ET, Brent crude for December delivery was down by 0.3%, trading at $74.12 per barrel, while West Texas Intermediate (WTI) crude for November delivery remained steady at $70.36 per barrel.

According to analysts from Standard Chartered, market sentiment remains heavily bearish, especially among speculative traders. This sentiment echoes the market’s mood during the onset of the Global Financial Crisis in 2008.

Supply and Demand Concerns Drive Market Sentiment

The primary cause of the bearish outlook stems from ongoing concerns about oversupply and weakening demand. Energy agencies have issued conflicting predictions regarding the future of the oil market. The International Energy Agency (IEA) forecasts that OPEC‘s crude oil output will rise by 700,000 barrels per day (kb/d) by 2025, with OPEC+ output increasing by 967kb/d and total Declaration of Cooperation (DoC) liquids output up by 1.323 million barrels per day (mb/d). On the other hand, OPEC Secretariat data—an average of assessments from seven secondary sources—aligns more closely with estimates from the U.S. Energy Information Administration (EIA) than with the IEA’s projections.

The IEA has further exacerbated concerns by predicting that global demand for fossil fuels will cease to grow this decade, just as supplies of oil and liquefied natural gas (LNG) are set to rise. This outlook is expected to put additional downward pressure on oil and gas prices.

Renewable Energy and Consumer Benefits

Despite the bearish forecast for fossil fuels, the IEA presents a more optimistic picture for consumers. The agency predicts that as renewables take on a larger role in the energy mix, electricity prices will begin to decline. IEA Executive Director Fatih Birol highlighted that the world is entering a new energy market phase, where prices for oil and gas will face significant downward pressure unless major geopolitical conflicts arise.

According to the IEA, electricity demand is expected to grow six times faster than total energy demand over the next decade, with electric vehicles projected to account for 50% of new car sales by 2030, compared to the current 20%. Additionally, the agency estimates that by 2030, the levelized cost of electricity (LCOE) for solar photovoltaic (PV) energy with storage in the U.S. will drop to $45 per megawatt-hour (MWh), considerably lower than the $70/MWh cost associated with natural gas.

“In energy history, we’ve witnessed the Age of Coal and the Age of Oil—and we’re now moving at speed into the Age of Electricity,” Birol remarked.

Renewables Expected to Drive Energy Costs Lower

The IEA’s outlook aligns with forecasts from the International Renewable Energy Agency (IRENA), which argues that renewable energy will reduce dependence on volatile fossil-fuel prices, lower average electricity system costs, and mitigate the impact of high energy prices on consumers and industry. By 2030, IRENA predicts that electricity generated from solar PV, concentrated solar power (CSP), onshore wind, and offshore wind will be significantly cheaper than fossil fuel-generated electricity.

Debate Over Peak Oil Demand

One of the most contentious issues in the energy market is the timeline for peak oil demand. Among the major energy agencies, only the IEA predicts that global oil demand will peak before 2030, even in its most optimistic forecasts. However, the IEA clarifies that a peak in demand does not necessarily signal an immediate decline in fossil fuel consumption, but rather a plateau that may last for several years.

In contrast, the EIA is more bullish on long-term oil demand, predicting that demand will not peak until 2050. OPEC, however, forecasts that peak oil demand will occur five years earlier, in 2045. Commodity experts at Standard Chartered project global oil demand to reach 110.2 mb/d by 2030, increasing to 113.5 mb/d by 2035. The bank does not anticipate a peak in demand within the next decade but warns that cyclical downturns could occur, contributing to investment uncertainty and pushing long-term oil prices higher.

Conclusion: No Consensus on Peak Oil

While energy agencies offer differing views on the timing of peak oil demand, they generally agree that it is not imminent. The debate over future oil demand continues to fuel uncertainty in the market, leaving investors and stakeholders grappling with a complex and evolving energy landscape.

Related topic:

How Much Fuel Oil Is Left In My Tank?