WTI crude oil prices have gained momentum following a rebound from the support zone around $66.85 per barrel. The price is now approaching a critical zone in the middle of its current range, with the possibility of another dip to the support level if this area fails to hold.

On the other hand, a sustained break above the support-turned-resistance level could open the door to a rally towards the $72 per barrel resistance or beyond. However, the broader technical outlook leans bearish, as indicated by the 100-day simple moving average (SMA) positioning below the 200-day SMA, suggesting downward pressure. Additionally, the gap between these moving averages continues to widen, signaling a strengthening bearish trend. The faster-moving 100 SMA also coincides with the current area of interest, reinforcing its role as a key resistance level.

Despite this, oscillators such as the Stochastic suggest there is room for further upside before reaching overbought conditions, implying that additional gains may be possible. However, a downturn in Stochastic could signal the return of selling pressure, potentially triggering a move lower if support breaks. Similarly, the Relative Strength Index (RSI) still has space before reaching overbought territory, meaning there could be continued upside momentum until buyers show signs of exhaustion. A breakout above the range resistance could set the stage for an uptrend matching the height of the current range pattern.

WTI crude oil has recently been bolstered by news of a production halt in Norway, coupled with escalating geopolitical tensions between Russia and Ukraine, which could further disrupt global oil supply from OPEC+ countries. These factors have contributed to the commodity’s rise, as traders closely monitor developments.

The market’s attention now shifts to upcoming inventory reports from the American Petroleum Institute (API) and the U.S. Energy Information Administration (EIA), which could add volatility to crude oil prices. A build-up in stockpiles could signal weaker demand, potentially leading to downward pressure. Conversely, a reduction in inventories could indicate tight supply, possibly fueling further price rallies.

Related topic:

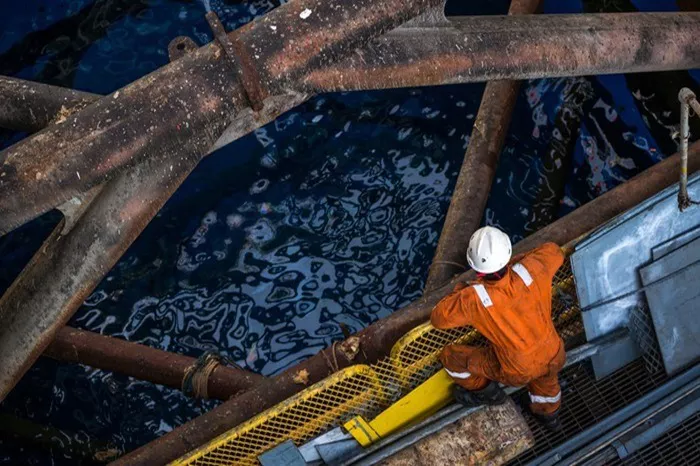

How Is Crude Oil Turned Into Gasoline?